To determine whether you should have life insurance or a savings account, first you need to know what life insurance does. A life insurance policy is a contract with your insurance company that provides money to your beneficiaries in the event of your death, while coverage is in force. Here are a few key terms that will help you navigate the world of life insurance:

- Beneficiaries: Your beneficiaries are the people or entities that would receive your death benefit should you pass away while your policy is active.

- Death benefit: This is the lump-sum payout that goes to the beneficiaries of your life insurance policy if you die within the terms of an active life insurance policy.

All the definitions and details may seem intimidating - and you may be wondering why not just set aside a portion of your income in a personal savings account. After all, wouldn’t that eliminate the issue of choosing the right plan and paying those monthly premiums?

There are two main types of life insurance:

- Permanent life insurance: There are two primary types of permanent life insurance (i.e. life insurance that doesn’t expire): whole life insurance and universal life insurance. With whole life or universal life insurance, you’re covered for your entire life as long as premiums are paid, and both typically include a savings element in addition to the death benefit. Whole life offers fixed premiums, while premiums for universal life can be flexible.

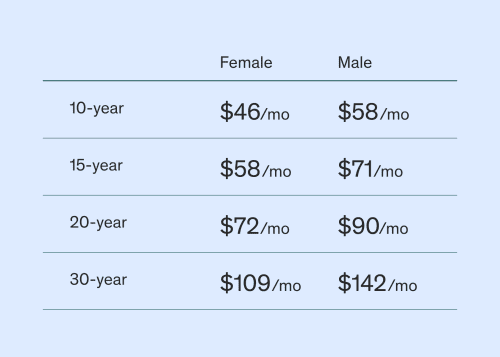

- Term life insurance: Term life insurance offers coverage for a specific period of time, when you need it most. At Ethos, we offer life insurance coverage between $20,000 to $1.5 million and term lengths ranging from 10 to 30 years. When your term life insurance policy ends, you may choose to renew the policy up to a specified age.

Here’s the real bottom line: It’s next to impossible to save the exact amount of money necessary for your family if you suddenly passed away. What you can control is how you prepare for the worst. Securing your loved ones’ futures with a policy alleviates anxiety, debt, and other financial obligations you may leave behind after your passing.

A look at the current economic climate in relation to life and death

It may be tough to think about, but a funeral will very likely be the first financial order of business your family has to tackle in the event of your death. The average cost of a funeral in the United States is upwards of $7,000. That’s the bare minimum amount your family would need to handle the necessary details in the wake of your death. According to a recent report, the average American household savings account balance is just $17,750. Not only would that number quickly be slashed by almost half in case of a funeral, but that doesn’t even account for the amount of average household debt, which is estimated at around $8,398. Based on those numbers, you can see how term insurance can protect your family during your income earning years. After that, your family will likely rely on the savings you’ve accumulated to cover any remaining debt that wasn't paid off during those income earning years.

What happens if a policyholder outlives their term policy?

Your policy is crucial during your earning years. Once you’ve established other funds and paid off any debt, your savings becomes an important source of funds in retirement. It doesn’t have to be, and shouldn’t be, an either-or situation. Having both a savings account and life insurance in place is important. Insurance can protect the now, while your savings can cover the future. By setting you and your family up to be financially secure after your income-earning years, your policy will no longer be your single source of financial safety. Therefore, outliving it won’t be an issue.

How you financially prepare your loved ones for the future is your responsibility. Given the costs of death in the family and the necessary steps to continue life after loss, a life insurance policy offers security, safety, and peace of mind.

There are many factors that life insurance companies take into consideration when calculating your premium, like your gender, age, family history, location, overall health, whether or not you smoke, your occupation, and your hobbies. Term life insurance is generally the most affordable life insurance option on the market.

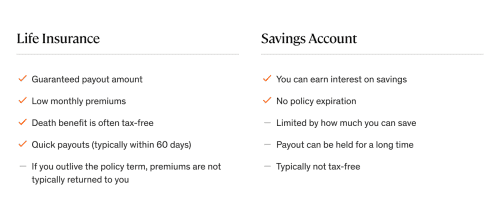

Having a life insurance policy means paying life insurance premiums. But those premiums ensure your beneficiaries get a solid, guaranteed lump sum death benefit if you pass away while your policy is active. In most cases, your death benefit is also tax-free and paid out quickly (within 30-60 days). While savings accounts are certainly a smart option for liquid emergency funds, they’re generally considered an insufficient option for covering the current and future costs around a death. If you’re facing an uncertain economy, that amount may not be enough to keep your loved ones protected, let alone comfortable.

Life insurance may seem intimidating, but it’s one of the best steps you can take today to protect what matters most. Traditionally, life insurance took months of paperwork, agent calls, visits, scheduling medical exams, and financial background checks. With the power of predictive analytics and machine learning, Ethos has made significant changes to our underwriting process to cover millions of families through a seamless online process.

With Ethos, you can secure your family’s financial future and home by visiting our life insurance quote calculator. We can determine a premium rate for you in minutes.

/Stocksy_txpd617015cclW200_Medium_2772165_fq8edr.jpg)

/Stocksy_txpd2ae323dqYV200_Medium_2347940_y1y3u1.jpg)

/CMS-LI-savings-header_q4coeq.jpg)