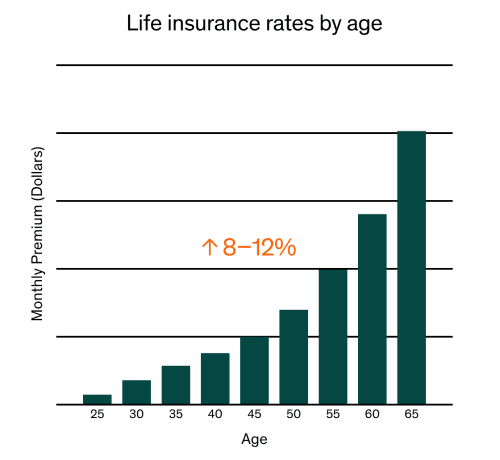

Generally, the earlier in life you buy a life insurance policy, the cheaper it is. Your premium rate is set when you sign the policy, and it won’t change during the term of the policy. But, as you get older, the cost of purchasing life insurance increases. Each year that you delay buying a life insurance policy, the cost of premiums increase by 8-12% on average.

For instance, a 40-year-old male, who is in good health and doesn’t smoke, could get a new, 20-year term policy with $1,000,000 of coverage for $2,172 a year. But if he waited a year and purchased the same policy at age 41 it would cost $2,340 a year —and $2,508 a year if purchased at age 42.

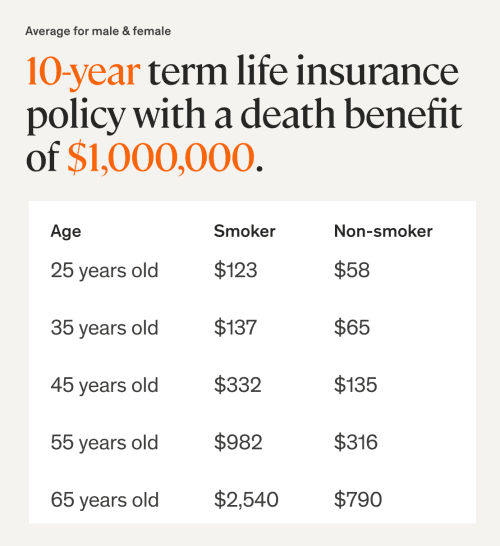

To evaluate this price increase, we looked at our own policies. This chart shows the change in average life insurance rates for different age groups. The term life insurance quotes shown are for a 10-year term life insurance policy with a death benefit of $1,000,000 for applicants who are in good health.

A 35-year-old non-smoker could get this policy and pay a monthly premium of $65, whereas a 45-year-old non-smoker could pay a $135 monthly premium. In this example, purchasing your policy at age 35 instead of 45 could save you $840 per year over the life of your policy.

A common myth is that you don't need life insurance until you have kids. Therefore many of us don't think about it until after getting pregnant or our kids are born. But this can cost you. Even if you don’t have a family to protect, life insurance can cover your personal debts, medical bills, and funeral expenses in the event of your passing.

Additionally, your health status is one of the most important factors in determining your premiums. The healthier you are, the less you’ll pay. As you get older and your health changes, you risk the chance of developing health issues (such as diabetes or cancer) that can lead to higher premiums and sometimes make it impossible to get coverage. Securing life insurance earlier in your life protects you, and whoever may depend on you, against any unexpected changes to your health down the road.

Employer-provided life insurance is nice to have! But unfortunately, it rarely offers enough coverage. Employer-sponsored policies typically offer coverage that is about 1-2X your annual salary. However, financial experts recommend having coverage that is about 10X your salary. And any changes in your employment status (such as retiring, changing jobs, or getting laid off) likely means you’ll lose this policy as well. If one of these changes happens when you’re older—or after you’ve developed a health issue—it could be harder and more expensive to secure new coverage. Having a previously purchased policy to supplement your employer plan protects you and your loved ones against life's unexpected changes.

Ethos has excellent ratings and works with some of the largest and most respected insurance companies in the world to make sure your policy stands the test of time.

/Stocksy_txp2f9ae4e7Z2j200_Large_2319519_qn4jj4.jpg)