Is a $500k Life Insurance Policy Enough?

/Ethos_Life-_Protect_Your_Family_3_auhubw.jpg)

How much life insurance do I need?

The proper coverage amount varies by individual. Determine if a $500,000 life insurance policy will be enough to protect those who depend on you financially if the unexpected occurs. It's recommended you carry a life insurance policy equal to ten times your annual salary. If you earn $50,000 a year, a $500k policy might be sufficient. But if you make more than that, you should consider purchasing a larger policy.

How do I calculate life insurance?

Use our easy coverage calculator to determine if a $500,000 life insurance policy is enough to meet your needs. Just answer a few questions about your health and finances and quickly get a quote that you can adjust to your preferences.

Rather than ballparking it, think about your family's real-life financial needs and how a comprehensive life insurance policy will provide the security you want for them. One useful way to calculate your coverage needs is the DIME formula (debt + income + mortgage + education). Adding these four factors together gives you a better idea of how much coverage you should consider:

Debt. This includes any outstanding debt, such as credit card bills, student loans, car payments, and burial expenses. Reducing these expenses now can provide your family with more financial security later.

Income. Many people also include a lost salary when estimating how much life insurance they need. Consider the number of dependent children you have and your spouse's ability to earn an income in the future. A good rule of thumb is to multiply your salary by the estimated years your family would need support. For example, if you earn $50,000 annually, a $500k life insurance policy will supplement your lost income for ten years.

Mortgage. If you still have years to go in paying off your mortgage, you may want to take this into consideration.

Education. If you have children, estimate the costs associated with their future educational needs, including private school and college tuition.

Also, consider how long you want the policy term to last. A whole life insurance policy lasts throughout your lifetime, but it comes with a lower benefit payment. This type of policy is typically favored by older people who want to cover their final expenses and leave a smaller payout for their beneficiaries.

A term life policy lasts from 10 years to 30 years and can be purchased at any age. When determining how much you need, think about the milestones you'll want your policy to cover. Do you want to leave enough to take care of your kids until they reach college? How much of a retirement nest egg do you want to leave your spouse? Have you thought about leaving an inheritance for future generations? The answers to these questions will impact how much coverage you need and whether $500k in life insurance is enough to meet those goals.

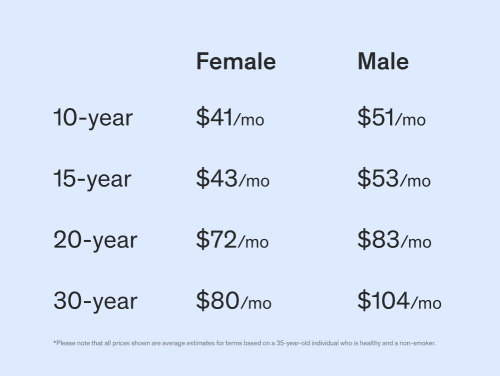

How much does a $500k life insurance policy cost?

That depends on various factors, such as your gender, age, smoking status, and overall health. Consider the average monthly cost of life insurance for 35-year-old non-smoking males and females in good health. For a 10-year term policy*, females could pay an average monthly premium of $41, while males may pay roughly $51. For a 30-year term policy*, those premiums jump to $80 and $104 per month, respectively.

What if my coverage needs change?

A $500k life insurance policy may seem sufficient for your current financial needs, but it's wise to reassess your coverage occasionally. You may want to consider increasing your coverage if circumstances change, such as having another child or purchasing a more expensive house. It's easy to get an updated quote based on your changing situation. Your revised policy will replace your existing one, ensuring your financial security stays in line with life's unexpected changes.

/life-insurance-boy-holding-hands-with-parents.jpg)