The basics

Having term life insurance is a simple and affordable way to provide financial protection for your loved ones in case you passed. Because they wouldn’t just lose you—they’d lose all the financial support you provide.

It's simple

Think of term life insurance like a subscription. You buy a certain amount of coverage for a set period of time (your “term”) and pay an insurance company a flat-rate premium every month. This guarantees that your beneficiaries would receive a lump-sum payout (known as the “death benefit”) if you passed away during your term.

What your policy can cover

It’s ultimately up to your beneficiaries to decide how to use the payout. People often use it to help cover things like:

- Home mortgages

- Lost income and debt

- Children’s college tuition

- Living expenses

- Funeral costs

How much does term life insurance cost?

It’s different for everyone and varies based on your unique situation. The biggest factors that can affect your premium include:

- Your coverage amount and term length: Less coverage and shorter term lengths tend to cost less

- Your age: Younger people typically have lower rates

- Your health status: Healthier people typically have lower rates

- Your tobacco use: Non-smokers typically have lower rates

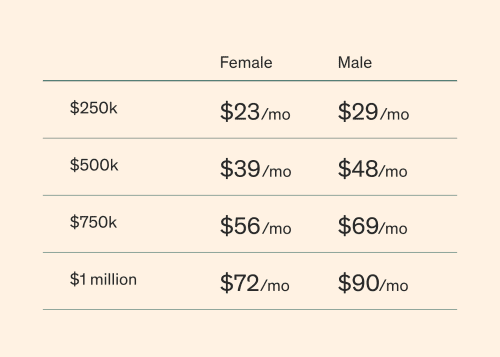

Here are some example prices for healthy, nonsmoking men and women in their 30s for various coverage levels and a 20-year term policy.

Did you know?

Most Americans overestimate the cost of life insurance by 3X or more. You might be surprised at how affordable it can be.

Please note that all prices quoted are subject to change, including due to underwriting.

/Stocksy_txp3c65d1b0TvY200_Medium_2812526_crop_r7ptdm.jpg)