Life Insurance Guide

If you’re new to the world of life insurance, it’s easy to get overwhelmed by all the confusing jargon and information out there. But the idea behind it is simple: Life insurance can help your family maintain the lifestyle they love and provide long-lasting financial security, should anything unexpected happen to you. It's a great way to plan ahead and protect the future you're building for your family.

So, what is it, how does it work, and do you need it? Find out everything you need to know to get started.

/life-insurance-father-and-daughter-playing-instrument.jpg)

A life insurance policy is a contract between you and an insurance company.

In that contract, you agree to make payments (premiums) to the insurance company for a specified period of time (sometimes for the duration of your life), and the insurance company agrees to provide a lump-sum cash payout ("death benefit") in the event that you pass away within the duration of the policy. The contract is legally binding and government-regulated.

When you buy a life insurance policy, you pay the insurer and name beneficiaries who would typically receive a tax-free payout (death benefit) if you were to pass away while the policy is active.

In its simplest state, every life insurance policy is made of these four components:

- Policyholder - The person who owns the life insurance policy and is paying the premiums. Typically, this is the person who applied for and is insured under the policy, but it’s also possible to purchase a policy on behalf of someone else.

- Beneficiary - The person(s) or entity, people, business entity, or institution(s) that receive the death benefit if the policyholder dies. You can name one person (or more) as beneficiaries when you purchase a policy.

- Premium - The money paid monthly or annually to keep a policy active (or “in-force”) during the term. Payment ensures that the insurance company will provide your beneficiaries with the stated benefit in the event of your passing. If you stop paying premiums, the policy lapses.

- Death benefit - The money paid out if the insured person passes away. Death benefits are not subject to an income tax and beneficiaries generally receive the benefit in one lump-sum payment.

Not everyone needs life insurance. However, most people can benefit from some sort of coverage.

According to LIMRA, one in three families might not be able to meet their day-to-day expenses within a month of the primary breadwinner’s death.

A life insurance policy can help your family maintain the lifestyle they've grown to love and provide long-lasting financial security.

/Stocksy_txp28a6fa48tsW200_Medium_830326_hvgqb1.jpg)

Term life insurance is the most simple and affordable option. It provides coverage for a set period of time or “term” (typically 10–30 years), and is designed to protect your dependents during that term. If you pass away during the term period, your beneficiaries receive a cash payment referred to as the “death benefit” to cover expenses or income loss related to your passing.

Think of term life insurance like a subscription. For example, John, a healthy 35-year old buys a 15-year term policy with $1 million in coverage to provide financial protection for his family until they have enough retirement saved. He pays a $47 monthly premium to keep the policy in place over the 15-year term (similar to a subscription). If he were to pass away during the term, his beneficiary (typically a spouse or child) would receive the entirety of his coverage ($1 million in this example), tax-free. If John passes away after the 15 year term, a death benefit would not be paid; instead his family would rely on the retirement savings accumulated during the time John’s income was protected by insurance.

Permanent insurance is more complex than term, and it offers different benefits. Whole life is the most well-known and simplest form of permanent life insurance. While term life insurance lasts for a specified term, whole life insurance lasts for the rest of your life. A payout is guaranteed at the time of death for your policy’s beneficiaries, and some of the money paid into the policy (your premium) is set aside to build “cash value” which can increase the death benefit or be accessed on a tax-free basis with a policy loan. Advocates for whole life policies say this is a more conservative, long-term strategy over buying term insurance. These features are why whole life policies can cost up to 5-10X more than term policies. (Financial Mentor, "Whole Life Insurance – The Essential Guide"; Flagstone Financial Management, "Term Versus Whole Life Insurance")

Some financial planning experts argue that purchasing whole life insurance isn't worth the cost. That's because of the higher premiums and low return on the cash value component. It’s possible to accumulate more wealth while you are alive if you invest the cost savings from buying a term policy vs. a permanent policy in the stock market or even traditional means, such as a 401(k) account, IRAs, and bonds. However, whole life insurance policies are useful for some people who need lifelong coverage and want the safety and guarantees the product provide. It also can be used as an effective way of estate planning for those with high incomes who have already maxed out their other tax-deferred accounts. Whole Life insurance can be added to your will as a way to pass on a legacy to your heirs.

If you have questions or would like to chat with one of our licensed professionals to find the right coverage, contact us.

Ethos offers term life insurance policies because term insurance can be a better financial choice for many families. Particularly if:

- You need to replace your income over a specified period of time (for example raising children or paying off a mortgage).

- You want the most affordable coverage.

- You want a more streamlined and straightforward process.

For people aged 66+ who want to protect their loved ones from financial burden after their passing, Ethos offers guaranteed whole life policies. Guaranteed whole life insurance is right for you if:

- You have previously been declined for life insurance

- You thought you could not get life insurance due to your age or health

- You don’t want your family to have to worry about your final expenses

If you've purchased a home, life insurance is a great option to help cover the expense of a mortgage payment. This will also help support any co-signers on your home in the event that you unexpectedly pass away.

Life insurance can help your loved ones pay for living expenses, tuition, debts, and other expenses your income supported.

Whether you work or stay at home, you’re responsible for taking care of your children. Especially if you’re a single parent, life insurance can provide financial stability to your children should something happen to you and help cover the costs of living, education, and more.

If you're married or have a domestic partner, life insurance can protect your loved one and the life you are building together. It can help cover your lost income and shared expenses such as credit card balances, car loans, and monthly rent, so you leave your partner in a good financial situation.

Even if you’re single with no children, life insurance can be a good idea if you carry debt. Some student loans won’t be discharged due to bankruptcy or death, so coverage can help alleviate the financial burden on your family.

Life insurance can also protect your business. It can be used to pay off your business debts or help the company stay afloat while they learn to get along without you.

Small life insurance policies can pay for your funeral and final expenses so that burden isn't left to your family.

In addition to protecting your family from inheriting your debt, life insurance can help provide support for anyone that depends on you, like aging parents or siblings. You may also want to consider buying life insurance while you're young so that by the time you need it, you do not have to pay more due to your age.

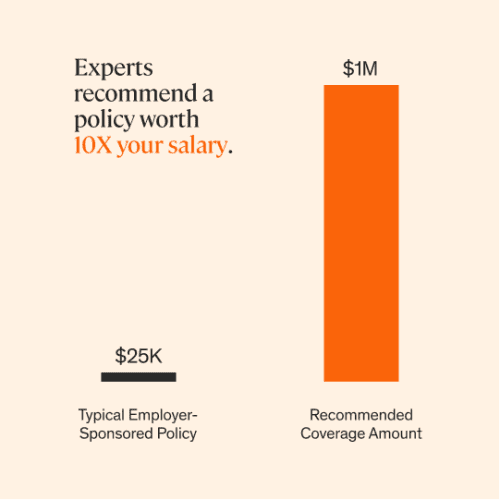

Employer-sponsored life insurance is a great benefit, but it might not provide enough coverage to protect your family. Employer-sponsored policies typically offer coverage that's 1-2X your annual salary. So if you make $50,000 per year, your employer may offer $100,000 in life insurance coverage at very little cost to you. This could be helpful, but how long would it last? Most experts recommend coverage that’s 10X your annual salary, or the total your family would need to replace your income for years to come and help cover costs like living expenses, child care, college tuition, bills, and mortgage payments.

Another disadvantage of relying on employer-sponsored coverage is that most policies end when you leave the company, whether you change jobs, are laid off, or retire. Which could mean losing your insurance when your family would need it most.

Many people find that it’s more cost-effective and protective to have an individual policy either in place of, or in addition to, your work policy.

In general, you can find your ideal coverage amount by calculating your long-term financial obligations and then subtracting your assets. The remainder is the gap that life insurance needs to fill. But it can be difficult to know what to include in your calculations, so we created a term life insurance calculator to help you determine your coverage needs.

There also are a few rules of thumb meant to help you decide how much you need. One rule of thumb is to simply multiply your annual income by 10. With that said, some is better than none. You can also use the DIME formula as a starting point in calculating your life insurance needs. DIME is an acronym for Debt, Income, Mortgage, and Education.

If you are looking for guaranteed issue whole life insurance however, you are likely looking to cover final expenses so you should look into any remaining debt you have as well as the costs associated with the type of funeral you want.

The total monetary value of all debt (student loans, credit cards, car loans, etc.) You’ll also want to include funeral expenses in that debt figure.

Take your annual income and multiply it by the number of years your family will need the support (i.e until your youngest child reaches a predetermined age, such as 18, 21, or 25). For example, if you make $50,000 per year after taxes and your youngest child is 10 and you want income protection until he or she is 21, then the income formula would be $50,000 x 11 years = $550,000. If you’re a stay-at-home parent, include the cost to replace the services that you provide, such as childcare.

Having enough life insurance can help keep your family in your home. With this step, simply add up the remaining balance on your mortgage. If you are renting, consider adding 10 years of rental income to your plan as a substitute.

Determine the cost of sending your children to college or private school. It is common to estimate $100,000 per child for a four-year university education at a state school. That includes tuition fees, room and board, and books.

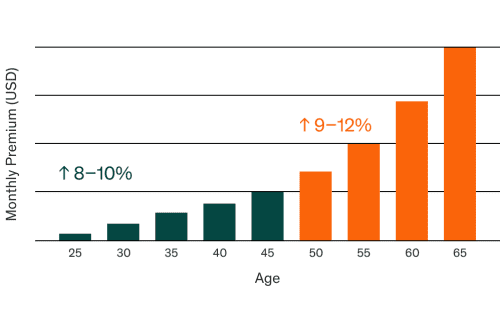

Since life insurance becomes more expensive as you age, the sooner you buy it, the more affordable it will be. In fact, you can expect your premium to increase on average between 8 and 12% every year you wait ("How Age Affects Life Insurance", Investopedia). Applying today means you can lock in a low rate for a policy that’s guaranteed to not increase throughout contract.

Choose a policy that’s right for you. Ethos offers a range of coverage options, so you can personalize your coverage to fit your needs. See your options

If you’re not sure exactly how much coverage you need, you can use our life insurance calculator to help you decide.

After you choose your plan, you can apply for coverage. Unlike traditional life insurance companies, our application can be completed online in minutes. We only ask what we need to know so your policy can be appropriately priced.

Once your application is submitted, we’ll process the information to provide you a quick (sometimes instant) decision on coverage eligibility and your rate. If approved, you can activate your coverage immediately.

We never require medical exams unless it’s absolutely necessary. We designed our process to reduce the number of extra steps like blood work, doctor visits, and meetings with agents. However, some people may still be required to take a medical exam to finalize their term life insurance coverage. With Ethos, it’s always free.

Once you’re approved, you'll sign a contract with the insurer. Your contract specifies the terms and conditions of your coverage and the premiums you’ll pay.

You pay your policy’s premiums on time monthly, twice a year or annually—as specified in your contract. Your life insurance policy becomes active as soon as you make your first premium payment. If you stop paying your premiums, the policy will lapse. If the policy lapses, it is no longer active (or “in-force”), and no death benefit will be paid.

In the event of your death, your designated beneficiary can file a claim with the insurance carrier. The carrier will work with your beneficiary during the claims process to facilitate the payment of the death benefit proceeds.

The cost of your policy can vary based on several factors, including the type of policy and amount of coverage, in addition to your gender, age, lifestyle and your health and term length for term policies. Some of these factors are within your control. For example, people who don’t smoke or use tobacco products typically pay significantly less for life insurance than those who do.

Shorter term lengths for term policies, and smaller coverage amounts will generally cost less. But that doesn't mean you should automatically select a 10-year policy over a 20-year policy or a $10K policy over a $100K policies. The right policy should cover your family until debts are paid off and you have enough retirement income, or your children no longer depend on you financially.

Life insurance can be confusing and even a little overwhelming for many people. But it doesn’t have to be. Ultimately, life insurance is about getting peace of mind knowing your loved ones are covered. Our team is here to answer any questions you may have along the way. Call us at (415) 915-0665 or email support@ethoslife.com.

/Stocksy_txp8e8ecc72JKW200_Large_2635053_fqvycz.jpg)

Life insurance is a financial contract providing a predetermined sum to beneficiaries upon the insured's qualified death. It is a crucial safety net, helping to ensure financial security for loved ones. The policyholder pays regular premiums, and in return, the insurer guarantees a payout to beneficiaries, covering various expenses determined by the beneficiary if the insured were to pass away.

Life insurance works by helping to provide financial protection for your loved ones in case you pass away. You pay regular premiums to the insurance company, and in return, they promise to pay out a sum of money (death benefit) to your beneficiaries. This money can help cover various expenses like funeral costs, debts, and living expenses. The type of life insurance and the coverage amount depends on your needs and preferences. It helps to ensure that your family is financially secure during a difficult time and can continue their lives without facing significant financial burdens.

Life insurance is deemed safe due to its guaranteed payout structure. As long as the payments are made according to the policy schedule, beneficiaries receive a predetermined sum when the insured passes away, helping to provide a reliable and secure financial safety net for their future.

Life insurance can cover death-related expenses, including funeral costs, outstanding debts, and ongoing living expenses for beneficiaries. This coverage helps to ensure that the financial needs of loved ones are met after the insured's death. How the death benefit is spent is up to the beneficiary.

Individuals prefer life insurance to help secure the financial future of their loved ones. It can help provide a sense of security and peace of mind, knowing that a death benefit can help beneficiaries be financially supported in the event of the insured's death.

The primary benefit of life insurance is the death benefit. It can help to assure policyholders that their loved ones can be financially supported after their passing, providing emotional security and stability during challenging times.

The timeframe for a life insurance policy to become effective varies. The question "When does a life insurance policy typically become effective?" depends on the underwriting process. Typically taking a few weeks, this process involves evaluating the applicant's health, lifestyle, and other factors before approval and activation. However, with Ethos, our underwriting is often instant, resulting in the option for same-day activation.