Life insurance for parents: what you need to know

/_Life_insurance_guide_for_new_parents_fh2gfp.jpg)

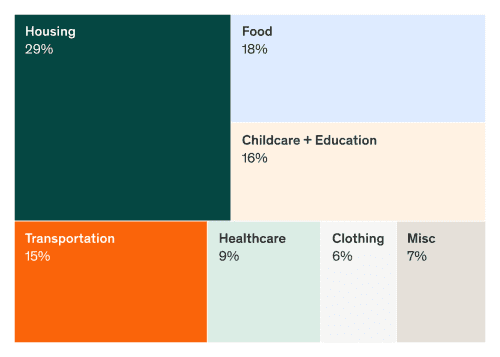

Kids are expensive to bring up. From the crib to college can be costly. Based on data from the 2022 Brookings study, an average middle-income family can expect to spend around $311k to raise a child to the age of 18. That includes the cost of your home, childcare, and day-to-day necessities like food and clothing.

But that doesn't even factor in higher education. With college tuition costs going up every year, how can you ensure your children will be able to afford a good education if you're no longer around? According to a recent study by U.S. News & World Report, average tuition and fees at private universities have risen 144%, and public institutions have jumped 211%. Even if your family qualifies for financial aid, it may not be enough to cover the rising costs of a college education.

Whether you already have children or plan to in the future, financial and insurance experts recommend that you understand the cost of having a family and how life insurance can protect your loved ones if you pass away unexpectedly.

Every parent should seriously consider buying life insurance. The first step is to understand your options when deciding what type and amount of coverage work best for your family. Financial experts recommend selecting a coverage amount equal to the number of years you think your family may need to rely on your income if you pass away unexpectedly. If you already have a life insurance policy, you're off to a great start—but be sure to reassess your situation to determine if you have enough coverage to protect your growing family. Remember, life insurance is more than an optional financial product—it's an essential factor when planning for the future.

/new-parents-highlight01_2x_1_vh9phc.png)

Often, the sooner, the better when it comes to purchasing life insurance. Getting your financial situation in order before starting a family can help give you peace of mind. Keep in mind that the earlier you secure a life insurance plan, the more affordable your premiums will usually be.

Even if you're not earning a salary, you should still consider carrying life insurance. Consider all the value you provide to your family as a stay-at-home parent. More than half of all families using childcare spend over $10k per year. And if a stay-at-home parent made an annual salary, it would equate to around $178k, according to Salary.com.

Never underestimate your value as a stay-at-home parent. Having a life insurance policy is just one more way you can contribute to your family's financial well-being when it's needed most.

Your beneficiary is the person, persons, or designated trust that receive your life insurance policy proceeds if you die while your policy is active. As the policy owner, you select your primary beneficiary (or beneficiaries) when you fill out your application.

If you're a parent, the primary beneficiary is typically your spouse, life partner, or children. Your life insurance benefit could help offset your income, pay off outstanding debt, cover education costs, and alleviate your loved ones' everyday living expenses for years to come.

Every family's needs are different. There are two primary types of life insurance: whole life and term life.

Whole life insurance is permanent and remains in effect for the insured's lifetime, as long as the premium gets paid. Term life insurance provides coverage for a specific period. Ethos offers term lengths between 10 and 30 years and coverage options from $20,000 to $2 million. With term life, you pay a fixed premium for the duration of the policy, so your rate never increases.

To choose the best plan for your family, consider your current financial situation. Suppose you're a new parent and want a 30-year term life policy that provides coverage until your child reaches adulthood. If your kids are in college, you might only want a 10-year term to cover educational expenses and any other unexpected situations if you pass away before they finish school.

New parents looking for life insurance often choose term life insurance because the monthly premiums can be a fraction of the cost of a whole life policy. Term life may be a good life insurance policy for new parents since it provides coverage for the years you need it most and won't cost you when you no longer need it.

The goal of purchasing life insurance isn’t just to replace your earnings, but protect your loved ones from financial crises. Think of all the significant financial obligations that may be left behind if you died unexpectedly—from your home and business to debts that you’ve cosigned on.

A simple rule of thumb is to multiply your salary by 10 to replace lost income. Then, you’ll want to add on any debt you might have, including mortgage payments, estimated education costs, child and general household care, and other daily expenses. You may also want to add extra coverage that would help cover your spouse's income for a year or two, so that the surviving parent wouldn't have to worry about returning to work immediately while grieving. If your spouse is a stay-at-home parent, consider adding a rough estimate of what their annual salary would be if they suddenly had to return to work. Learn more about choosing the right type of life insurance plan and how much a life insurance policy will cost to protect your family.

You can use this life insurance calculator from Ethos to help get an estimate of how much coverage you need and what your policy could cost.

There's no one-size-fits-all approach to purchasing life insurance. There are various factors to consider when determining your family's specific needs, from mortgage payments and outstanding debt to day-to-day expenses and tuition. That's especially true if your family is growing.

The main goal of buying life insurance for many is to ensure your loved ones have financial security if you were to pass away suddenly. Think about all the significant financial obligations your family would be left to deal with if the unexpected were to happen.

So, how much coverage is enough? A simple rule is to multiply your annual salary by 10 to replace lost income. Then calculate your debt, mortgage, estimated education costs, child and household care, and other everyday expenses. If your spouse also works, consider extra coverage so they won't feel obligated to return to work immediately. On the other hand, if they're a stay-at-home parent, estimate what their annual salary would be if they suddenly had to return to work.

Use Ethos's life insurance calculator to understand how much coverage you should have and how much your monthly premiums will be.

/new-parent-inset_2x_hhrukc.png)