Whole life is the most well-known and simplest form of permanent life insurance. While term life insurance lasts for a specified term, whole life insurance is designed to last for the rest of your life. A death benefit is paid at the time of death for your policy’s beneficiaries, and some of the money paid into the policy (your premium) is set aside to build “cash value.” You can use this cash value for emergencies or to supplement retirement income by taking a policy loan against the cash value. Note that outstanding policy loans will decrease the amount of the death benefit paid to your beneficiaries.

Whole life insurance might be right for you if:

- You want coverage for the rest of your life

- You want a policy that builds cash value over time

- You want a policy that can be used for legacy planning or to help cover your final expenses

- You’re willing to pay a higher premium for the unique benefits of this coverage

The main differentiating factor of whole life insurance is that it lasts for your entire life and can be used as a way to invest in your future—unlike term policies, which expire after your chosen length and have no cash value component. For these reasons, whole life insurance policies typically cost 5-15 times more than term policies for the same amount of coverage.

Whole life insurance may be a good option for those with slightly more complex financial situations, or someone seeking the security of coverage for the remainder of their life. Term life is a good fit for those who want the most affordable coverage or who need to replace their income over a certain period, for example until children are no longer dependent or the mortgage is paid off.

For many people, age and health issues make it difficult to get access to life insurance. That’s why we work with AAA Life to offer guaranteed issue whole life insurance. If you’re 65-85 years old, you’re guaranteed to be approved in a matter of minutes, regardless of your medical history (and without medical exams). For real. And with a secure rate that will never increase, you’re covered for life.

Your quote is the same as your final rate, and the rate you get today will never go up (as long as you keep up with payments).

This is a whole life insurance policy, which means it builds cash value automatically. When available, you can borrow against this cash value for unexpected emergencies, or even to pay medical bills or go on vacation. Keep in mind that annual loan interest will be applied to any outstanding loan balance, so it’s a good idea to pay it back if you can. The final death benefit will be reduced by any outstanding loans you have taken on the policy and any premium due.

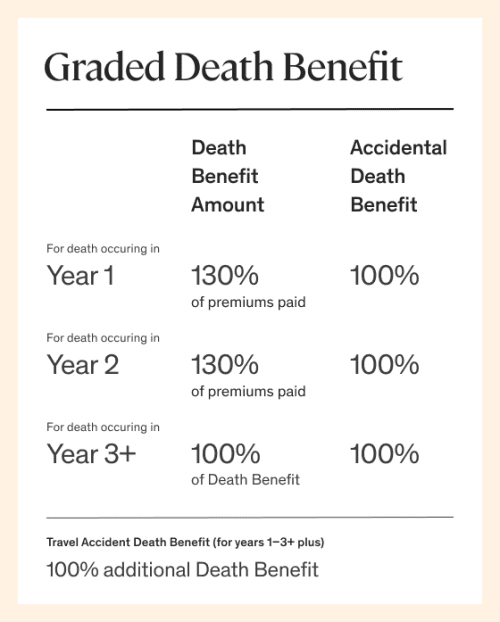

This policy contains a modified benefit clause, which means if you suffer a covered accidental death, you get the full amount of your coverage. But if you suffer a non-accidental death within the first two years of coverage, your beneficiaries get 100% of the premiums payable, plus an extra 30%. After two years, the full Benefit Amount is payable for death due to any cause.

Beginning in the third policy year, grading no longer applies. The benefit will be 100% of the policy (minus any outstanding loans/premiums and debt), unless the death is caused by a covered travel-related accident, in which case the death benefit would be 200% of the policy.

Before you buy this policy, Ethos is available to help you with any questions via phone, email, text, and chat. Once you buy this policy, you’ll have the assistance of AAA Life's Customer Support team. You can reach their support team Monday-Friday from 8am–8pm ET, and on Saturdays from 11am–3pm ET.

After the first two policy years, the Death Benefit is calculated as follows:

- Face Amount; plus

- Premium paid past policy month of death; less

- Any policy debt; less

- Premium required to keep policy in force if death occurs during grace period.

If the insured dies, the beneficiary will not receive the entire death benefit if there is an outstanding policy loan.

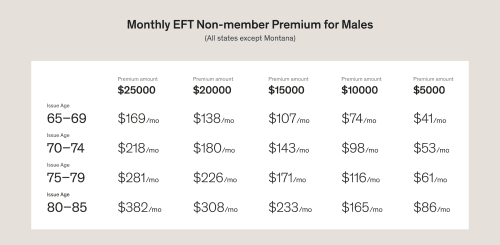

Heads up: You’ll have higher premiums. Because you’re guaranteed to be approved no matter what, this life insurance is more expensive than other types of coverage out there. Your age, gender, and the coverage amount you choose are the only factors that affect your price. Your health or past medical history won’t affect your rate, and you won’t need any medical exams, either. In many cases, this is the best option for people who are likely to be denied coverage elsewhere or who are viewed as “uninsurable” by other carriers.

The quote is the same as the final rate. It’s also guaranteed never to go up. As long as premiums are paid when due, the rate you see now will be locked in for as long as you have this insurance.

No medical exams, lab tests, or questions about your health. For real.

Our life insurance experts are available to answer all your questions. You can call, email, or chat with us if you have questions or want honest advice. Our team is non-commissioned, meaning their motivation is to help you find the right coverage for your needs, not sell you more.

- Email support@ethoslife.com anytime

- Call (415) 915-0665 or text (415) 702-1844